Bribes and influence peddling

TABLE OF CONTENTS

Bribes are the lifeblood of kleptocracy. They enrich the powerful and keep them in power. At the same time, they impoverish those who cannot afford them and keep the average person out of decision-making.

Bribes are rarely as explicit as a direct payment. Rather, they often pass through a third party—an organization, a person, or an account.

Whether Donald Trump has actually received bribes is a question for the courts. What is clear, however, is that the amount of money (and other valuable things) that passed hands before and after the election was unprecedented. Those who donate to his 2024 campaign have received significant awards.

Suspicious political finance transactions

Political finance covers all the spending that political candidates, parties, and interest groups engage in to influence elections.

Kleptocrats may funnel public resources into their re-election campaigns. They may ask for off-the-book donations from their supporters. They may also ask for – entirely legal – donations to their campaigns when direct bribes would be too difficult to conceal. This becomes especially problematic when they funnel some of that money back to themselves or use that money to protect themselves from the consequences of breaking the law.

The Trump administration has already engaged in numerous suspicious political finance transactions. In the US, Political Action Committees (PACs) and Super PACs can spend unlimited amounts of money to advocate for or against political candidates, provided they do not coordinate directly with the campaigns. Beyond this, however, are several political finance transactions that deserve a closer look.

ACTION 1 | Elon Musk buys Special Government Employee Status

Donald Trump’s campaign has seen absolutely unprecedented third-party spending, with Elon Musk alone donating more than $250 million. The law requires such donations to be uncoordinated with the official Trump campaign. Reporting raises significant questions about whether spending was uncoordinated, as required. Thus far, legal action has not been taken. Since the election, reporting by ABC News and Wired suggests that Musk has reaped numerous benefits, including relief from investigation, access to to data, and federal contracts (see "Cronyism and Favoritism"). He also received Special Government Employee status and was given access to numerous classified federal data systems. (Last updated 4/21/25)

ACTION 2 | Campaign finance money pays Trump's personal legal bills

The Trump campaign used as much as $100 million in election funds for personal legal bills, according to the Brennan Center for Justice. The New York Times reported that small donor contributions to Trump’s campaign were diverted to provide legal defense from illegal actions taken during his first administration and after he left office. (Last updated 2/21/25)

ACTION 3 | Moving campaign donations into mystery firms

In September of 2025, the Associated Press reported that Launchpad Strategies received $15 million from Trump's election fundraising without disclosing its operations or leadership, raising questions about potential self-dealing and the influence of undisclosed donors. Launchpad is one of several firms with mysterious ownership, incorporated in Delaware and receiving fundraising proceeds. Who is receiving this money and for what is unclear.

This resembles practices during the first Trump administration. Campaign Legal Center filed a complaint to the Federal Electoral Commission (FEC) in July 2020 alleging that a company, American Made Media, concealed payments to people “under the direction and control of the campaign.” In 2020, FEC attorneys recommended a formal investigation into the Make America Great Again fundraising committee. They argued that Trump campaign manager, Brad Parscale, was “routing campaign staff salary payments” through his firm to Lara Trump, the president’s daughter-in-law, and Kimberly Guilfoyle, who was later engaged to Donald Trump Jr. Votes from at least four of the six commissioners are required to move ahead with an investigation. FEC commissioners discontinued the probe with a split 3-3 decision in 2024.

Concerns about new suspicious funding remain. But it will be unlikely that four-member FEC will get to a unanimous decision, especially after the controversial—and reportedly illegal—attempted firing of outspoken member Ellen Weintraub (stay tuned for a new section on “Election Oversight”). (Last updated 4/21/25)

Meme coins

Cryptocurrencies are complex codes that can be exchanged for value. When they are traded, they may be traced in terms of where they are “stored,” but their specific owners remain anonymous. In the United States, banking regulations make secrecy of ownership difficult (but not impossible). Cryptocurrencies provide one way to circumvent the ownership reporting requirements of the banking system. That makes them a preferred method of money laundering and bribes.

Openly taking bribes is illegal and unpopular. For that reason, kleptocrats regularly launder those bribes. This happens through third-party agents and opaque financial and legal structures. Cryptocurrencies are a growing part of how ill-gotten gains—including the proceeds from bribery—are laundered.

The Trump family has a personal stake in the cryptocurrency industry through its company World Liberty Financial. Their continued direct involvement in a market they are supposed to be regulating has no historical equivalent in US history.

ACTION 4 | The Trump family releases meme coins, opening the door to foreign bribery

The Trump family issued two meme coins shortly before the inauguration in January 2025. While in office, the president is making money off of trading fees and each tranche of coins as they are released. The president (and his immediate family) are making money off of a business he is responsible for regulating. More than that, it opens the door to potential bribes, as individuals may buy large amounts of the virtual currencies and announce that they need favors (see "See Action 16: Crypto moguls buy legal reprieve and Trump investment," below.).

Upon release, the value of these meme coins increased dramatically, driven, to a large extent, by foreign investors, including major Chinese buyers. It then dropped precipitously when tariffs on trade partners were announced. This could have been the sign of a mere “pump and dump” scheme, or, as others have pointed out, this could have been the intentional withdrawal of state-related actors. Either way, directly owning a cryptocurrency business creates an easy channel for donors and potential bribe-payers to avoid restrictions and transparency requirements. (Last updated 4/21/25)

ACTION 5 | The Trump family's crypto conflicts

Political action committees aligned with cryptocurrency were among the biggest spenders in the 2024 election season and biggest donors to inaugural parties. Members of the industry have received concrete benefits from the Trump administration.

Since President Trump’s inauguration, the Securities and Exchange Commission has dropped lawsuits against major crypto firms like Coinbase and Kraken, lifting a legal cloud over the industry.

President Trump also signed an executive order in March calling for the creation of a national crypto reserve—a government stockpile containing Bitcoin and other digital currencies. This would move a huge amount of taxpayer dollars into a national stockpile, a tremendous boon to the financial technology companies that run it, including World Liberty Financial.

The president spoke at a conference in March 2025, calling for “common-sense” legislation on stablecoins. A few days later, the president's company, World Liberty Financial, released a stablecoin called "USD1." This comes immediately as Congress is in the process of negotiating its first major legislation on the currencies. The fact that the president directly owns a large share of the regulated industries raises questions about the motivations behind the president's actions. In whose interest is he signing legislation? (Last updated 4/21/25)

The Trump family's conflicts of interest

Conflicts of interest are areas where an elected official (or close family member or associate) has a business interest that overlaps with their official duties. The conflict can lead the official to act in their personal interest rather than the public interest.

Trump’s businesses continue to be a potential channel for ill-gotten gains. Throughout his first term, President Trump maintained ownership of the Trump Organization, a conglomerate with global real estate and branding interests. Although Trump pledged to separate his political role from his business dealings, Citizens for Responsibility and Ethics in Washington (CREW) documented 3,700 conflicts of interest during his first term. These included visits to Trump properties by foreign officials and significant taxpayer spending at Trump-owned businesses. (Last updated 3/21/25)

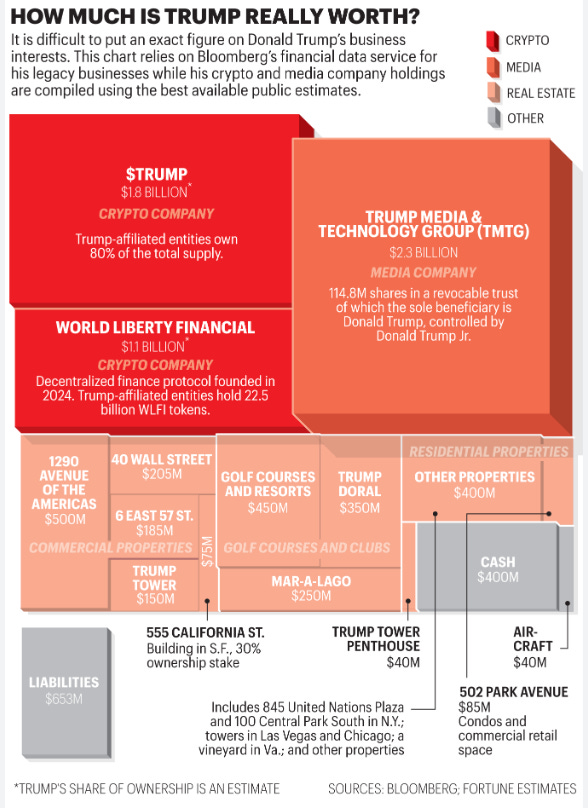

During his second administration, however, Trump has diversified his portfolio. Fortune Magazine estimates that most of his money now comes from crypto currency ($3.9 billion) and social media ($2.3 billion), compared to the licensing and real estate that comprised most of his income during his first term. (Golf courses, real estate, and cash continue to account for an additional estimated $3 billion.) Real estate and licensing provided numerous vectors for influence before. With the new businesses—cryptocurrency and publicly traded stock—covert influence is easier than ever.

ACTION 6 | Trump's companies lift a ban on foreign deals

Opaque foreign interests remain a concern. In his second term, the president's private company, the Trump Organization, shifted its ethics policy to allow deals with private foreign entities, a departure from the previous ban on foreign engagements. This change has intensified concerns about potential policy influence by foreign investors seeking favor through business ties with the Trump family. (Last updated 3/21/25)

ACTION 7 | Hiring family members

Conflicts of interest are not only about businesses. They also include bringing in family members to serve in lucrative public posts. During the first Trump administration, Trump’s son-in-law, Jared Kushner, served as a senior advisor, including on Middle East issues. Post-administration, Kushner secured a $1.4 billion luxury resort development project in Albania and established a private equity firm, Affinity Partners, heavily funded by Middle Eastern investors, including the Saudi sovereign wealth fund. More recently, President Trump has moved to appoint his daughters’ fathers-in-law to key positions following major donations. For example, Massad Boulos, Tiffany Trump's father-in-law, is negotiating a critical minerals deal in war-torn Democratic Republic of Congo. (Last updated 4/21/25)

ACTION 8 | Real estate and licensing deals open the door to foreign emoluments

Real estate ownership provides another path for undue influence through "foreign emoluments," or the profits received through someone's official position, which would represent a conflict of interest. Traditionally, presidents are expected to put their assets—especially stocks and other financial investments—into blind trusts to avoid such a conflict. Real estate cannot be so easily managed. During the first administration, Republican lawmakers spent millions at Trump’s hotel, with use of the hotel all but disappearing following a change in branding. This suggested significant amounts of patronage. With a second term underway, the pattern continues. The Republican National Committee held its retreat at Trump’s Doral Hotel. The Wall Street Journal reports that the Trump Organization is looking to attach its name to what was once the Trump Hotel in Washington DC once more. This opens a broad channel through which patronage can now flow. The problem does not stop at the border. As reported in AP News, the Trump Organization's continued international business engagements in Vietnam, Saudi Arabia, and the United Arab Emirates have raised concerns about potential conflicts. (Last updated 3/21/25)

ACTION 9 | Trump media stock is a vector for influence

Media, too, is rife with potential conflict. Donald Trump has a controlling interest in the Trump Media and Technology Group (TMTG). This is the parent company of Truth Social, established between his two terms. This is a publicly traded company. According to Noah Bookbinder of CREW: “Anyone, whether it’s a wealthy individual or a foreign country, that buys a large number of shares is likely to push the stock value up, which immediately drives up Donald Trump’s net worth—and it could go much further than renting hotel rooms or planning an event at a Trump property. There’s also the threat that those interests could quickly sell off the stock, which would drive prices down and potentially tank Trump’s net worth, which gives them further leverage.” (Last updated 4/21/25)

ACTION 10 | Selling products from the White House

The Trump family has racked up a wide range of business ventures that sell products, including water, vodka, bibles, and steaks. Since returning to the White House, President Trump has continued pitching products to his supporters. In addition to his meme coins—likely the most consequential—President Trump continues to promote and sell MAGA merchandise that will build a war chest that his supporters say could reach $500 million mid-2025. Given the opaque structure of the companies that produce these goods, this is another area of potential conflict of interest.

ACTION 11 | Kash Patel, FBI Director, continues to sell political products

President Trump is not the only member of his administration who is hawking merchandise while in office. FBI Director Kash Patel sells and has endorsed a wide variety of products on social media, including a series of children's books celebrating MAGA storylines, a credit card, and Nocovidium, and a supplement purported to "rid your body of the harms of the vax." (Last updated 4/21/25)

ACTION 12 | Turning the White House into a Tesla showroom

Elon Musk is the presidential campaign's largest single donor, head of the so-called Department of Government Efficiency (DOGE), and owner of the Tesla automotive company, among numerous other business ventures. With the Tesla stock price falling precipitously (41% between election day and March 15, 2025), President Trump began encouraging the American public to purchase Tesla vehicles. On March 11, 2025, Trump turned the South Lawn of the White House into a temporary Tesla showroom. While the event was livestreamed by White House staff on X (the social media platform owned by Musk), President Trump declared that the vehicles were "beautiful" and the "coolest design." Trump himself reportedly bought at least one Tesla vehicle. Legal experts agree that this move was unethical and potentially illegal. A week later, US Commerce Secretary Howard Lutnick urged the public to buy Tesla stock, saying, "it will never be this cheap." Except for very limited circumstances, conflict of interest rules prohibit federal employees from using their “government position or title or any authority associated with his public office to endorse any product, service or enterprise.” (Last updated 4/21/25)

ACTION 13 | The Justice Department inflates vandalism charges against Tesla into terrorism

The Justice Department has also stepped in to support Tesla. Following instances of vandalism of Tesla locations and cars, Attorney General Pam Bondi categorized Tesla vandalism as "domestic terrorism" and said that, if convicted, suspects would face sentences would be between five and 20 years. According to the New York Times, President Trump has asserted that Tesla vandals should be sent to prison complexes in El Salvador. (Last updated 4/21/25)

ACTION 14 | Selling influence by candlelight

Guests are paying up to $5 million for individual meetings with President Trump at Mar-a-Lago. According to Axios, the MAGA Inc super PAC has advised donors that $1 million will buy them a seat at the "Candlelight Dinner." Proceeds are reportedly set to fund the $500 million war chest that Trump is accumulating to "help political allies, punish opponents and help Republicans keep full control of Congress in 2026." Though second-term presidents have held fundraisers for their parties, these events are unprecedented in terms of the amounts raised and their timing so early in a new administration. (Last updated 4/21/25)

ACTION 15 | NVIDIA buys influence and US stockholders pay the price

In the first week of April 2025, Jensen Huang, CEO of Nvidia, reportedly paid for one of Trump's candlelight dinners, sending markets and national security into chaos. During the meeting, he is said to have requested that export controls for the high-power H2O AI chips be rescinded. Several days later, the export controls were lifted, sending Nvidia stock soaring. After grave concerns about American national security and competitiveness, export controls were put back in place, causing the US stock market to lose over 2% of its value in a single day. The fact that the fate of a strategic national industry can be decided by megadonor during a private meeting is a deeply dangerous use of public office. (Last updated 4/21/25)

ACTION 16 | Crypto moguls buy legal reprieve and Trump investment

In 2023, the Securities and Exchange Commission charged Chinese cryptocurrency mogul Justin Sun with fraudulently manipulating markets to pump up his cryptocurrency's value. The SEC alleged that Sun accomplished this through "wash trading," when traders sell to themselves to create the appearance of active trading when in fact no money is changing hands. In addition, Sun reportedly paid celebrities including Lindsey Lohan, Jake Paul, and Lil Yachty to endorse his currencies without disclosing that these were paid endorsements. In November of 2024, Sun became an advisor to World Liberty Financial.

CNN reported that within weeks of Donald Trump’s inauguration, Sun quietly invested at least $75 million into World Liberty Financial, the centerpiece of Trump’s new cryptocurrency empire. The investment pushed the company over its $30 million threshold, triggering a clause that routes 75% of net revenue directly to Trump or his affiliates. Days later, the SEC suddenly paused its civil fraud case against Sun and began discussing a settlement. Trump’s crypto venture, which includes the $TRUMP meme coin and a forthcoming fintech investment fund, has already netted insiders nearly $100 million in profits. With crypto’s anonymity shielding donor identities, this scheme creates an untraceable pipeline for potential influence—foreign or domestic—bypassing campaign finance laws. It is a new architecture for an old story: trading access and impunity for personal profit.

Sun is not alone. Crypto market maker DWF has been accused of artificially inflating token prices on the Binance exchange. According to the Coingeek blog, Binance’s market surveillance team identified over $300 million in wash trades by DWF on behalf of its clients. Binance's response was to fire its surveillance team, according to the Wall Street Journal. DWF purchased $25 million in World Liberty Financial and, perhaps because it was unafraid of regulatory enforcement, established a physical presence in the United States. (Last updated 4/21/25)

ACTION 17 | Trump uses his office to broker a peace accord between Golf moguls...and profits

In February, President Trump worked to broker an agreement between two rival golf tournaments: the US-based PGA Tour and the LIV Golf league, funded by Saudi Arabia. While the Biden administration held off on approving a merger between the two tournaments, President Trump is actively working towards the "reunification of golf," as reported by the BBC. A potential deal would blur the lines between business and politics as the Trump family business stands to benefit financially. The Trump family owns and manages golf courses around the world. Journalists have reported that, in April 2025, the Trump family's Doral resort hosted an LIV tournament and had extensive dealings with Saudi Arabia, including various real estate projects and a $2 billion investment from the kingdom's sovereign wealth fund into Jared Kushner's company.

ACTION 18 | Administration officials own things overseas that raise national security concerns

Typically, when someone enters the public service or is appointed, they divest themselves of overseas interests. This way, the American people know that an elected official is acting in the national interest, rather than their own. Numerous Trump officials own assets abroad or work for companies that continue to raise questions about whose interest they may work for.

Kash Patel, the Director of the FBI, owns up to $5 million in stock of the company Elite Depot Ltd., which is the parent company of clothing brand Shein (in addition to numerous other documented business interests). In testimony to Congress, he signaled no intent to divest himself of the stock.

Elon Musk has numerous ties to China, which remains a core part of his manufacturing interests. The businessman raised eyebrows when it was reported that he would receive a top secret briefing on potential military conflict with China. Given his ambiguous and irregular status as a government employee, there was some relief when he was disallowed to attend the meeting.

Ed Martin, United States Attorney for the District of Columbia, which oversees many of the most important federal investigations, failed to disclose that he was a paid Russia Today consultant, part of the propaganda arm of the Russian government.

And, of course, Donald Trump and his family have billions in overseas properties, including no less that 19 new overseas projects in the works as of April 2025, according to CREW. During the first Trump term, the Trump family stopped doing overseas business deals. During the second term, their ethics plan contains no such limitations.

(Last updated 4/21/25)